The government lockdowns due to COVID-19 have meant many SMEs face uncertainty and significant cash flow strain over the coming months. Businesses need to plan for significant disruption over the next 18 months. An accurate rolling cash flow forecast is the ideal tool for lessening the impact of COVID-19, assessing the available options and finding the right solutions to sustain the business through the disruption. Download our free 13 week cash flow forecasting spreadsheet. Read the full guide below.

How does a good cash forecast help you respond to COVID-19?

At it’s basic level, a good cash flow forecast gives you confidence that the business has sufficient cash to operate without disruption over the weeks and months that lie ahead.

It brings the future performance of the business into the present view so if problems lie ahead, they can be investigated and addressed. In unpredictable uncertain environments like we all currently face, this makes forecasting an ideal tool to keep your business healthy and sustainable over the coming weeks and months.

Here’s how it works.

5 step guide to developing your forecast and Action Plan for COVID-19:

Step 1

Understand when and how cash flow issues could arise over the coming weeks and months in different scenarios

(e.g. the impact on cash flow of a 25% fall in sales vs a 50% fall in sales)

Step 2

Develop a strategy over the next 90 days to ease cash flow pressures

(e.g. government support, financing, scaling back)

Step 3

Understand how long the business can meet its ongoing cost, and when and how much it may need to borrow

(e.g. in 2 months, we will exceed our overdraft limit)

Step 4

Obtain the necessary finance by demonstrating to lenders that the business can repay the amounts it borrows.

Step 5

Update your rolling forecast each period to monitor cash flow and keep the business healthy during the uncertainty

The challenges with forecasting cash during COVID-19

Whilst forecasting is therefore an essential task as part of your response to COVID-19, in unpredictable volatile trading conditions, the future is hard to predict. It’s therefore all too easy to forecast the next 90 days inaccurately.

The advice and guidance we set out here is therefore tailored towards helping business owners develop an accurate forecast taking into account the disruption and uncertainties we face as a result of the coronavirus.

It should help you develop a clearer picture of your financial future so you can look forward over the next 90 days and develop a plan of how to sustain (or even develop) the business through the coronavirus crisis.

Here’s some tips and areas you should consider when preparing your cash forecasts.

Step 1: Understand when and how cash flow issues could arise

Do not use cash forecasting tools / software

In ‘normal times’ the past is usually a good starting point or base to predict future cash inflows and outflows. This is how many forecasting tools tend to work; using past performance as a means to forecast future cash flow.

We first therefore need to appreciate that the coronavirus has shifted our lives in such a drastic way over the past few weeks that how the business performed in the last quarter, is fairly irrelevant to forecasting how it will perform over the next quarter.

Therefore when deciding what tool to use to prepare your forecast, you will want to consider how how severely the business has been affected by COVID-19. If the shutdowns have had a severe impact on cash flow, you may not want to use a forecasting tools that use the past to forecast the future.

If you do use a forecasting tool which applies such an approach, consider what adjustments (some could be significant) you need to make to reflect what the next 13 weeks will look like.

Plan for the worst, hope for the best

Given the next 3 months will be hard to predict, you will be potentially making significant assumptions about future cash inflows and outflows. Given the current uncertainty about the very short term, it may naturally be very difficult to accurately assess your sales prospects. You should therefore plan for different circumstances and assess what cash flow will look like in both best and worst case scenarios.

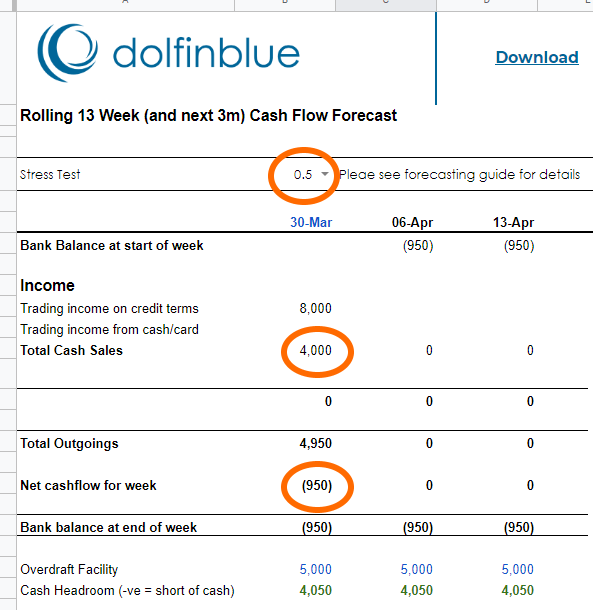

A quick way to do this on the fly is by stress testing your sales projections. We have included a dropdown in our free forecasting tool. This means you can for example assess what impact a fall of 50% in sales has on net cash flow overall.

By stress testing your sales, you can understand the number of sales required each period to cover all outgoings; or in other words your break even point in cash terms for each week.

Understand uncertainties around timings

Another aspect of uncertainty you will want to particularly consider when preparing your forecasts during the COVID-19 pandemic, is the uncertainty over when certain payments will be received. For example, there may be:

- Uncertainty over when amounts due from customers will actually be received.

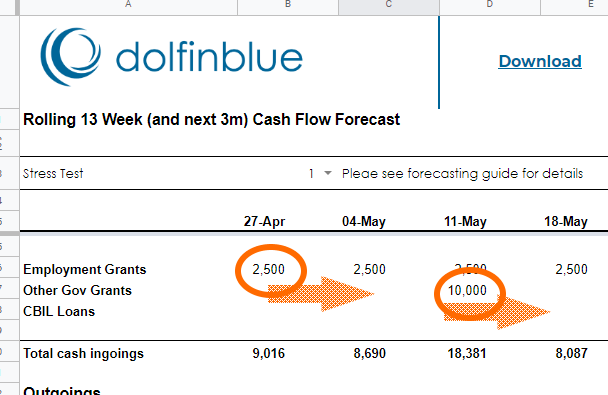

- Uncertainty over when government grants for ‘furloughed’ workers will be released under the Coronavirus Job Retention Scheme – see here.

- Uncertainty over how long it will take to receive funds under the Coronavirus Business Interruption Loan (CBIL) scheme for small and medium businesses – see here.

- When you may be able to negotiate new payment terms and credit with your own suppliers.

Consider best case and worst case scenarios in terms of the timing of cash inflows and outflows.

Step 2 – Develop a strategy over the next 90 days to ease cash flow pressures

Maintain an open dialogue with Customers, Suppliers, Contractors and Trading Partners

In order to develop your strategies to reduce cash flow pressures during the COVID-19 disruption, your first port of call should be maintaining an open dialogue with your key customers, suppliers, contractors and so on; especially:

- Following with all suppliers you may be able to negotiate extended credit with.

- Negotiating different payment terms on existing loans and borrowing.

- Following up with landlords who you may be able to negotiate reduced or deferred rental payments.

- Following up with any significant other party you do business with that you have developed a strong and healthy working relationship with.

During challenging times, a common positive theme we see is people helping each other. Use the relationships you’ve developed over the years of doing business with one another to explore possible ways to ease cash flow pressures and talk through the options available.

Government Support schemes

Once you have established and negotiated payment terms with suppliers and customers, you should have a clearer idea bout your operational cash inflows and outflows over the next 13 weeks.

You now need to take account in your cash flow forecasts of the government support you’re expecting to receive over the next three months. Please see our government support articles for full details on timings and eligibility to these schemes.

The following government schemes may be applicable:

- ‘furloughing employees’: continuing to pay at least 80% of the employee’s wage and then claiming a grant from the government through the Coronavirus Job Retention Scheme. Wages will need to be paid as normal before the grant is later received which should be reflected in forecasts.

- Cash Grants for those eligible for Small Business Rates Relief and those in the hospitality, retail and leisure sector.

- Deferring next quarter’s VAT payment until March 2021.

- Deferring business rates payments for businesses in the hospitality, retail and leisure sector until 2021.

Cut non-essential costs to reflect new size and scale

The first step in assessing other cost reductions that could be made to ease cash flow is looking at variable costs . For example, if you have forecast total sales to drop by 30% over the next 13 weeks, you will be able to free up cash flow by cutting back your variable costs by a proportionate amount It’s therefore necessary to look closely at what variable costs can be scaled back to reflect the reduced (or increased) projected sales during COVID-19; whether this be materials, stock, wages or otherwise.

Outside of this, all ‘negotiable’ expenses should be looked at. These are non-essential costs the business may have been incurring to support goals and targets which have now been pushed back or scrapped as a result of COVID-19.

If you are forecasting a significant drop in sales, carefully review the expenses you are currently incurring which do not directly support the business’s current and most pressing needs and priorities. Consider whether these payments can be delayed for a time where there is less pressure on operational cash flow.

Do establish what opportunities exist

While COVID-19 created a seismic shift in the challenges and priorities of business owners, the same can also be said for our prospective customers. Adapting to their changing circumstances during the coronavirus lockdown may enable you to unlock new revenue streams that could help lessen the impact of sales lost elsewhere.

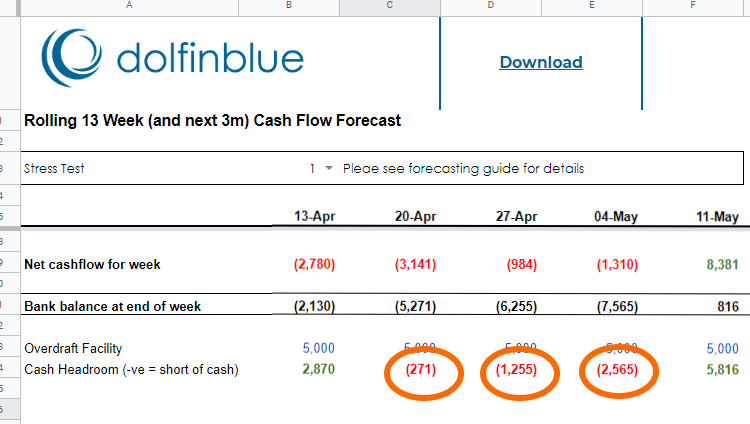

Step 3 – Understand how long the business can meet it’s costs, when it may need to borrow and to what extent

Once you have considered the above cash flow solutions and strategies, your forecasts should provide you with a much clearer picture of what cash flow will look like over the coming weeks and months. Ideally you will have multiple forecasts which assess different scenarios that could play out over the next 13 weeks so you can spot where potential cash gaps exist.

Your forecast can now be used to understand the financing needs of the business over the short term.

Step 4 – Obtain the necessary finance by demonstrating to lenders that the business can repay any amounts it borrows.

Reviewing your financing options

Given what your forecasts tell you about future cash inflows and outflows, evaluate what financing options are available to the business and if / when they should be pursued. Options include:

- Owner contributions

- Bank loans and overdraft facilities

- Government grants

- Government backed loans through the Coronavirus Business Interruption Loan scheme (CBIL)

- Other external financing options such as invoice financing and P2P lenders.

Evaluate how effective each solution would be in meeting the cash flow and sustainability needs of the business

Consider:

- The amount of time required to apply and obtain finance through each option available.

- The costs of borrowing and the ability to repay over different timeframes and scenarios.

- The timing of receiving of funds and whether they help resolve the cash flow issues you are trying to address

As part of the evaluation process, input the amount you expect to receive via each financing route into your forecasts to understand the overall effect on cash flow week by week.

Streamline the application process

Timing could be key to finding and implementing an effective solution. Once you have identified your options, you should be aiming to streamline and simplify the application process wherever you can.

Dolfinblue partner with Capitalise who allow you to submit one application to multiple potential lenders. By answering questions and submitting your financial plan to the Capitalise platform, you can receive responses from up to 100 lenders including 10 lenders who offer the Coronavirus Business Interruption Loan scheme.

Book a free assessment of your finance options and next steps here

The cash flow forecasts prepared as part of this process can be developed to support your application and demonstrate to lenders that the business is able to meet repayments as and when they fall due.

Streamline the application process wherever possible

Step 5 – Update your rolling forecast each period to monitor cash flow effectively during the coronavirus crisis

The template provided is intended to be used as a rolling forecast. This simply means you update the forecast each period. Once the first week has passed, it’s removed and another week is added to the end of the forecast.

Rolling forecasts are ideally suited to fast moving unpredictable environments like what we face as a result of the coronavirus. Unlike a static forecast, a rolling forecast will enable you to monitor the health and performance of the business continously over the next 13 weeks.

Secondly, due to the uncertainty and unpredictability, a one-off static forecast could well be inaccurate within just a few days if it fails to reflect the most recent developments and events. In the past week alone, the government have announced a number of schemes to support businesses. You may have held conversations with key suppliers and customers over the past week.

A rolling forecasts which is updated each period would reflect these changes; allowing you to adapt and respond to events as they unravel. This makes rolling forecasts a hugely preferable planning tool for sustaining your business through the coronavirus outbreak.

Conclusion

No business plan or existing strategy could possibly be fit to guide your business through an economic and government shutdown on the scale we’re currently experiencing. There’s consequently an urgent need for a new plan; focused on sustaining and navigating the business through the extreme disruption and uncertainty we all currently face.

Preparing accurate cash flow forecasts will be a vital tool in understanding the risks, finding solutions, and monitoring progress over time.

Download our free Cashflow Forecasting Tool – for managing your cash flow effectively during COVID-19

Instructions:

- Download the Cash Flow Forecasting template

- Instructions on how to complete your forecast are provided a the top of the spreadsheet

- Once you have read the instructions and guidance, using the + and – icons in row 21 to hide

- Prepare your forecasts and follow the four step plan outlined in this guide.

- Use the form below if you have questions or require further support

Support is available

Concerned about the impact the coronavirus is having on your business? Need help developing your business during COVID-19? Need help accessing Government Support?

- Book a free Business Health Check we'll answer your questions and review what solutions and financial support are available to your business: Book Now

- Read our free resource on how to access the Coronavirus Government Support announced for businesses so far: Read Now

- Access our free COVID-19 Action Plan to understand what areas of your business you need to review: Download Now

- Have questions? Leave your details below and we’ll get back to you as soon as possible: